Cannabis News of Note for the Week:

Politico Pro Cannabis: Key Republican Says His Party Has Discomfort with Weed (paywalled newsletter, full text below)

Cannabis Wire: Dama Financial ruffled feathers at last week’s SAFE hearing (newsletter, full text below)

Green Market Report: SAFE Act Gave Stocks a Slight High, Earnings Harshed That Buzz

Bloomberg Gov: America’s on Board – Acceptance of pot is climbing in the US (newsletter, full text below)

Marijuana Moment: Regulators And Advocates Discuss Next Steps For Marijuana Interstate Commerce

MJ Biz Daily: Safe Harbor, New York institution create marijuana banking partnership

Cannabis Reports of Note for the Week:

States That Legalize Marijuana See Reduced Tobacco Use, Study Finds

—

Politico Pro Cannabis: Key Republican Says His Party Has Discomfort with Weed

Sen. Kevin Cramer (R-N.D.), a cosponsor of the cannabis banking bill and a member of the Banking Committee, says his party is still hesitant to get on board with cannabis legislation — even piecemeal bills like SAFE.

“I can only speculate why the others didn’t participate,” he told Natalie, referring to the number of Republican senators who did not show up to question witnesses at Thursday’s hearing on the bill. “I just think there’s a general discomfort with the topic.”

The hearing, he added, was efficient because there aren’t a lot of issues with the bill itself. Instead, the conversation is going to come down to how lawmakers feel about cannabis in general.

“Are you comfortable with where your states are and what they need of you?” Cramer asked. “And are you comfortable with where this bill is?”

VANCE STILL UNDECIDED — Freshman Ohio Sen. J.D. Vance (R) is apparently one of the senators still trying to answer Cramer’s question. Vance told Natalie on Thursday that he is still undecided on the SAFE Banking Act. Each GOP Senator who could be brought on board will be crucial to passage, and Vance brings extra power as a member of the Banking Committee.

“I certainly have concerns with the bill,” Vance said Thursday. “But we’re still going to do our work and figure out what do I want to vote — yes or no.”

Factors weighing on Vance: Ohio already has a legal medical marijuana industry, and a recreational legalization initiative may appear on the ballot this November. A millennial born in 1984, Vance is less likely to have the generational opposition to marijuana that some older lawmakers on both sides of the aisle have. He has already endorsed Donald Trump in the 2024 election, and Trump’s voters in some states (like Florida) have polled high on support for marijuana legalization. Vance did, however, vote against the veterans cannabis research bill that failed to pass a cloture vote at the end of April.

—

Cannabis Wire: Dama Financial ruffled feathers at last week’s SAFE hearing.

Kim Rivers, CEO of MSO Trulieve, tweeted yesterday afternoon that she spoke with the CEO of Dama Financial.

Some context: Michelle Sullivan, chief risk & compliance officer for Dama Financial, called for the SAFE Banking Act language to include a “tougher framework” and enhanced rules on areas like risk limits, deposit ratios, due diligence, and ongoing monitoring requirements, “especially as it pertains to cash deposits and legacy cash,” as Cannabis Wire reported.

“We also believe that there is a serious potential for confusion in the banking industry following the passage of this legislation, the way it’s currently written. Will the cash truly get out of the system?” Sullivan asked. “We do know that credit card companies have policies against banking illegal products which may prohibit cannabis transactions running across those rails, even after the SAFE Banking Act passes. Without solving the larger decriminalization issue, we worry the passage of the SAFE Banking Act alone could actually provide worse problems and a sense of resolution, while huge conflicts at the federal level still exist.”

Sullivan even suggested a “pause” so that members of Congress can study these issues, among others.

Rivers tweeted yesterday that she is “hopeful they will be issuing a statement into the committee record making it clear that they do support SAFE in its current form and that it does provide a workable structure for the industry.”

The tone of Dama’s testimony wasn’t cheerleading, and could have come off as oppositional. Rivers tweeted that Sullivan was a “Compliance officer opining as to what a perfect bill may look like instead of expressing the company’s support of the current bill.” Dama’s CEO, meanwhile, Rivers tweeted, was “very clear that they support the current bill and that their support did not adequately come thru at the hearing.”

—

Bloomberg Gov: America’s on Board

By Tiffany Kary

Cannabis may face financial and regulatory malaise in the US, but that isn’t affecting the perceptions of consumers, who increasingly approve of it.

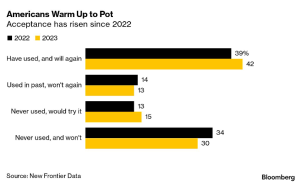

A survey of nearly 4,400 US marijuana consumers and 1,200 nonusers shows how acceptance and use have grown over the past year alongside the expanding legal and illicit markets. More people report using marijuana, while naysayers are dwindling, according to New Frontier Data, a cannabis consulting firm.

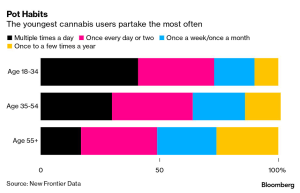

The study also showed that about a third of weed consumers use it multiple times a day, despite new data showing links between heavy marijuana use and health problems such as schizophrenia and heart disease.

An estimated 42% of US consumers have used cannabis and plan to use it again — up from 39% a year ago, the report found. On the flip side, only 30% said they had never used it and never would, down from 34% a year ago. More people were also open to trying it for the first time, while only 13% said they’d never use it again, a percentage point lower than in 2022.

The snapshot shows an increasingly cannabis-friendly US consumer. For example, 31% of cannabis consumers use it multiple times a day. Among ages 18 to 34, the trend was even more pronounced, with 41% of consumers using multiple times daily. Those numbers have declined since last year, when they were 36% and 46%, respectively. But there’s still no indication that peak pot is coming soon: As more states legalize, the industry is projected to grow 17% to $34 billion in sales in 2023, according to New Frontier’s estimates.

The data shows rising approval despite the fact that legalizing marijuana hasn’t panned out as planned. Creating state-licensed sales was supposed to create a safe supply and get rid of the health risks and organized crime that came with the illicit market.

Instead, underground sales of the drug have grown over the past few years, rising to $77 billion in 2022 from $70 billion in 2020, according to New Frontier estimates.

The report does project that the illicit market will decline to $73 billion in 2023, however. The legal market is projected by New Frontier to grow steadily in the coming years while the illicit market is seen slipping slightly.

Nor has cannabis replaced alcohol use, as proponents of “California Sober” have hoped. The study found instead that cannabis users are more likely to consume alcohol, and generally do it more often. While only 21% of cannabis nonusers drink alcohol a few times a week, 34% of cannabis users drink that often, the report found.

Despite the projections for growth, marijuana stocks have slumped in recent years amid stalled progress toward legalization at the federal level. While a growing number of states are legalizing cannabis, federal lawmakers have been unable to break an impasse on legislation that would give the industry greater access to financial services, let alone a full legalization. Last year, President Joe Biden called for a review of the drug’s classification — a process that could prove lengthy.